10+ E5 Salary Tips For Financial Freedom

Achieving financial freedom is a goal that many individuals strive for, especially those in the higher income brackets, such as those with salaries over 100,000 per year. However, having a high salary does not automatically guarantee financial freedom. It requires a combination of smart financial planning, disciplined spending habits, and strategic investment decisions. Here are 10+ tips tailored for individuals with E5 salaries (typically above 100,000) to help them navigate their financial journey towards freedom.

1. Budgeting Beyond the Salary

Creating a budget is the first step towards financial freedom. For high-income earners, it’s essential to allocate their income into needs, wants, savings, and investments wisely. The 50/30/20 rule can be a good starting point: 50% for necessary expenses, 30% for discretionary spending, and 20% for saving and debt repayment. However, individuals with E5 salaries may need to adjust these proportions based on their financial goals, such as aggressively saving for retirement or paying off high-interest debt.

2. Maximizing Tax-Advantaged Accounts

High-income individuals should take full advantage of tax-advantaged retirement accounts such as 401(k), IRA, or Roth IRA. These accounts can help reduce taxable income and grow retirement savings more efficiently. Contributing to these accounts, especially if an employer offers a match, can be one of the most effective ways to build wealth over time.

3. Investing Strategically

Investing is a critical component of achieving financial freedom. Diversifying investments across different asset classes, such as stocks, bonds, real estate, and potentially alternative investments, can help spread risk and increase potential returns. High-income earners may also consider working with a financial advisor to develop a personalized investment strategy.

4. Paying Off High-Interest Debt

Even high-income earners can find themselves with high-interest debt, such as credit card balances. Paying off this debt as quickly as possible is crucial, as it can save thousands of dollars in interest payments over time. Strategies like the debt snowball or debt avalanche can be effective, depending on personal preference and financial situation.

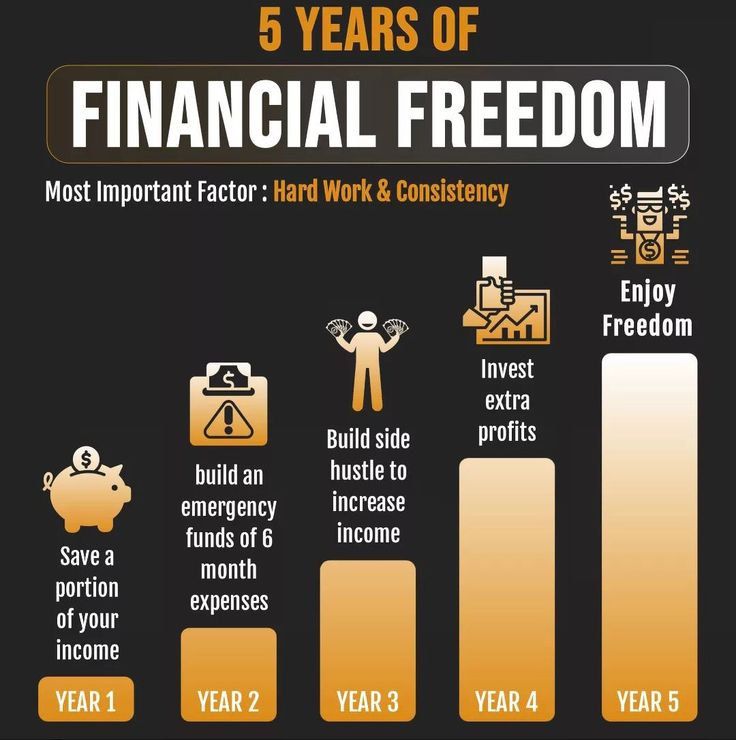

5. Building an Emergency Fund

Having an easily accessible savings fund to cover 3-6 months of living expenses is vital for financial stability and freedom. This fund acts as a buffer against unexpected expenses or job loss, allowing for the continuation of regular financial planning and investment activities without interruption.

6. Educating Yourself

Financial literacy is key to making informed decisions about money. High-income earners should continually educate themselves on personal finance, investing, and tax strategies. This knowledge can help in avoiding costly financial mistakes and in making the most of their financial resources.

7. Avoiding Lifestyle Inflation

One of the biggest challenges for those with increasing incomes is the temptation to inflate their lifestyle by spending more on luxuries. While some indulgence is acceptable, it’s essential to prioritize savings and investments over consumption to achieve long-term financial goals.

8. Considering Alternative Income Streams

Diversifying income streams can provide a safety net and increase wealth. High-income earners might explore starting a side business, investing in dividend-paying stocks, or pursuing real estate investing to create additional sources of income.

9. Planning for Major Purchases

For significant expenses like buying a home or funding a child’s education, planning ahead is crucial. Setting aside money in separate savings accounts or utilizing specific savings plans, such as 529 plans for education, can help manage these expenses without disrupting other financial goals.

10. Reviewing and Adjusting

Financial planning is not a one-time task; it requires regular review and adjustment. As income changes, so too should the financial plan. Regularly reviewing investments, budgets, and savings progress can help identify areas for improvement and ensure that financial goals remain on track.

11. Utilizing Financial Tools and Advisors

Leveraging financial tools, apps, and possibly working with a financial advisor can provide high-income earners with personalized advice and strategies tailored to their specific situation. These resources can help optimize financial decisions, from tax planning to investment management.

12. Giving Back

Finally, incorporating charitable giving into one’s financial plan can not only provide tax benefits but also a sense of fulfillment and purpose. High-income individuals might consider setting aside a portion of their income for donations or exploring philanthropic strategies that align with their values.

In conclusion, achieving financial freedom for those with E5 salaries involves a multi-faceted approach that includes smart budgeting, strategic investing, careful debt management, and a commitment to ongoing financial education. By following these tips and adapting them to their unique circumstances, high-income earners can better navigate the path to financial freedom and build a secure, prosperous future.

What is the best way to start saving for financial freedom on an E5 salary?

+Starting with a clear budget and allocating a significant portion towards savings and investments is key. Consider maximizing contributions to tax-advantaged accounts and exploring other investment opportunities.

How can I avoid lifestyle inflation with a high income?

+Set financial goals and prioritize them. Implement a budget that allocates funds towards these goals first, and then allow for discretionary spending. Regularly review and adjust your budget to ensure it remains aligned with your long-term objectives.

What role does investing play in achieving financial freedom?

+Investing is crucial for growing wealth over time. Consider diversifying your portfolio across different asset classes and possibly working with a financial advisor to develop a personalized investment strategy.