12 Florida Resale Certificate Tips To Save Money

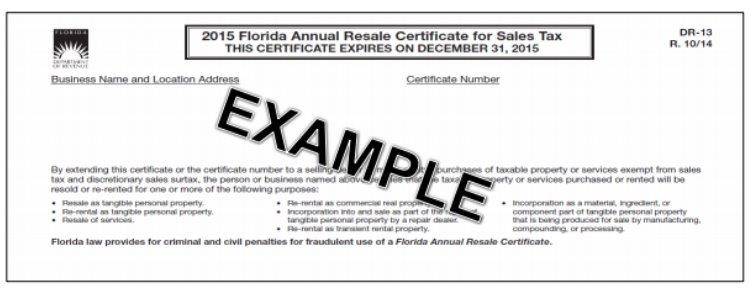

When it comes to navigating the world of resale certificates in Florida, having the right strategies can make all the difference in saving money and ensuring compliance with state regulations. A resale certificate, also known as a sales tax exemption certificate, is a document that allows businesses to purchase goods without paying sales tax, provided they intend to resell these items. Here are 12 valuable tips to help you leverage Florida resale certificates effectively, minimize tax liabilities, and optimize your business operations.

1. Understand the Purpose and Eligibility

Before applying for a resale certificate, it’s crucial to understand its purpose and your eligibility. This certificate is not just for retail businesses; any company that plans to resell goods can benefit from it. Ensure you comprehend how your business operations align with the requirements for obtaining and using a resale certificate in Florida.

2. Gather Necessary Documents

To apply for a resale certificate in Florida, you’ll need to gather specific documents. Typically, this includes your business registration documents, Employer Identification Number (EIN), and sometimes a copy of your sales tax permit. Make sure all your paperwork is in order to expedite the application process.

3. Fill Out the Application Correctly

The application for a resale certificate requires precise and accurate information. Missteps in the application process can lead to delays or even rejection. Take your time, and ensure every detail is correct and consistent with your business records.

4. Know the Difference Between Resale and Exemption

Understanding the distinction between a resale certificate and a tax exemption is vital. A resale certificate is used for items you plan to resell, while tax exemptions apply to specific goods or services that are exempt from sales tax by law, such as certain food items or machinery used in manufacturing.

5. Maintain Accurate Records

Keeping detailed records of all purchases made with a resale certificate is essential. The Florida Department of Revenue may audit your business, and having comprehensive records will help you demonstrate compliance and avoid potential penalties.

6. Resale Certificate for Out-of-State Purchases

If you’re purchasing goods from out-of-state sellers, you might still need to provide a resale certificate to avoid sales tax, depending on the seller’s requirements and the laws of their state. Be prepared to explain your business’s tax status and the purpose of your purchase.

7. Periodic Renewal

Resale certificates in Florida may require periodic renewal. Mark your calendar to ensure you submit your renewal application on time to avoid any interruption in your ability to make tax-free purchases.

8. Educate Your Staff

Ensure all relevant staff members understand the use and requirements of resale certificates. Misuse can lead to tax liabilities and penalties, so educating your team is a critical step in managing your certificates effectively.

9. Review Vendor Requirements

Some vendors might have specific requirements or forms they need you to fill out in addition to the state-issued resale certificate. Be prepared to accommodate these requests to maintain good relationships with your suppliers.

10. Stay Updated on Tax Law Changes

Tax laws and regulations can change frequently. Stay informed about any updates or amendments to Florida’s sales tax laws that might affect how you use your resale certificate or impact your business operations.

11. Audit Preparation

Always be prepared for an audit by maintaining organized and detailed records of all transactions where the resale certificate was used. This preparation will help you quickly respond to any inquiries and demonstrate your compliance with resale certificate regulations.

12. Consult with a Tax Professional

Lastly, consider consulting with a tax professional who is familiar with Florida’s sales tax laws. They can provide personalized advice tailored to your business’s specific situation, help you navigate complex tax regulations, and ensure you’re maximizing your savings while staying compliant.

Conclusion

Navigating the resale certificate process in Florida requires a combination of understanding the legal framework, maintaining meticulous records, and strategically planning your business’s purchases. By following these tips and staying vigilant about changes in tax laws and regulations, you can effectively use resale certificates to save money and propel your business forward.

FAQ Section

What is the primary purpose of a resale certificate in Florida?

+The primary purpose of a resale certificate in Florida is to allow businesses to purchase goods without paying sales tax, provided they intend to resell these items.

How often do I need to renew my resale certificate in Florida?

+Resale certificates in Florida may require periodic renewal. It’s essential to check with the Florida Department of Revenue for the most current information on renewal requirements.

Can I use a resale certificate for purchases made from out-of-state vendors?

+Yes, you might need to provide a resale certificate to out-of-state vendors to avoid sales tax, depending on the vendor’s requirements and the laws of their state.

What documents do I need to apply for a resale certificate in Florida?

+Typically, you’ll need your business registration documents, Employer Identification Number (EIN), and possibly a copy of your sales tax permit to apply for a resale certificate in Florida.

Why is it important to keep accurate records of purchases made with a resale certificate?

+Keeping accurate records is crucial because the Florida Department of Revenue may audit your business. Comprehensive records will help you demonstrate compliance with resale certificate regulations and avoid potential penalties.

Can I use a resale certificate for exempt goods or services?

+No, a resale certificate is specifically for goods you intend to resell. Exempt goods or services have their own set of regulations and might not require a resale certificate.