Allowance Of Uncollectible Accounts

The allowance for uncollectible accounts, also known as the allowance for doubtful accounts, is a crucial concept in accounting that helps businesses to accurately reflect the true value of their accounts receivable. This allowance represents the amount of accounts receivable that a company expects to be uncollectible, and it is a key component of a company’s financial statements.

Understanding the Concept

When a company sells goods or services on credit, it creates an account receivable, which is an asset that represents the amount of money that the customer owes to the company. However, not all customers will pay their debts, and some accounts may become uncollectible due to various reasons such as bankruptcy, fraud, or simply because the customer is unable to pay.

To account for these uncollectible accounts, companies use an allowance for doubtful accounts, which is a contra-asset account that reduces the value of the accounts receivable. This allowance is estimated based on the company’s historical experience with uncollectible accounts, as well as other factors such as the age of the accounts, the creditworthiness of the customers, and the overall economic conditions.

Estimating the Allowance

Estimating the allowance for uncollectible accounts requires a thorough analysis of a company’s accounts receivable and its historical experience with uncollectible accounts. There are several methods that companies can use to estimate the allowance, including:

- Percentage of Sales Method: This method involves estimating the allowance as a percentage of total sales. For example, if a company has historically experienced 2% of its sales as uncollectible, it may estimate its allowance as 2% of its current sales.

- Aging of Accounts Method: This method involves analyzing the age of the accounts receivable and estimating the allowance based on the age of the accounts. For example, a company may estimate that 10% of its accounts that are 30-60 days old will be uncollectible, while 20% of its accounts that are over 90 days old will be uncollectible.

- Direct Write-Off Method: This method involves directly writing off accounts that are deemed to be uncollectible. This method is not preferred as it does not match the expense with the revenue.

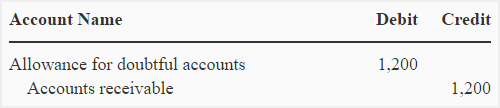

Recording the Allowance

Once the allowance for uncollectible accounts has been estimated, it is recorded as a debit to the bad debt expense account and a credit to the allowance for doubtful accounts account. For example:

Debit: Bad Debt Expense (1,000) Credit: Allowance for Doubtful Accounts (1,000)

Impact on Financial Statements

The allowance for uncollectible accounts has a significant impact on a company’s financial statements. It reduces the value of the accounts receivable, which in turn reduces the total assets of the company. The bad debt expense is also recorded as an expense on the income statement, which reduces the company’s net income.

Example

Suppose a company has 100,000 in accounts receivable and estimates that 5% of its accounts will be uncollectible. The company would record an allowance for doubtful accounts of 5,000 (5% of 100,000) and a bad debt expense of 5,000.

Debit: Bad Debt Expense (5,000) Credit: Allowance for Doubtful Accounts (5,000)

The company’s balance sheet would reflect the reduced value of the accounts receivable:

Accounts Receivable: 100,000 Less: Allowance for Doubtful Accounts: (5,000) Net Accounts Receivable: $95,000

Benefits and Limitations

The allowance for uncollectible accounts provides several benefits to companies, including:

- Matching Principle: It matches the bad debt expense with the revenue generated from the sales.

- Accurate Financial Reporting: It provides a more accurate picture of a company’s financial position by reducing the value of the accounts receivable.

- Risk Management: It helps companies to manage their credit risk by identifying potentially uncollectible accounts.

However, the allowance for uncollectible accounts also has some limitations, including:

- Subjectivity: The estimation of the allowance is subjective and may not accurately reflect the true value of the accounts receivable.

- Uncertainty: The allowance may not capture the uncertainty associated with the collection of accounts.

- Complexity: The estimation and recording of the allowance can be complex and require significant judgment.

What is the purpose of the allowance for uncollectible accounts?

+The purpose of the allowance for uncollectible accounts is to provide a more accurate picture of a company's financial position by reducing the value of the accounts receivable to reflect the amount of accounts that are expected to be uncollectible.

How is the allowance for uncollectible accounts estimated?

+The allowance for uncollectible accounts can be estimated using various methods, including the percentage of sales method, the aging of accounts method, and the direct write-off method.

What is the impact of the allowance for uncollectible accounts on a company's financial statements?

+The allowance for uncollectible accounts reduces the value of the accounts receivable, which in turn reduces the total assets of the company. The bad debt expense is also recorded as an expense on the income statement, which reduces the company's net income.

In conclusion, the allowance for uncollectible accounts is an essential concept in accounting that helps companies to accurately reflect the true value of their accounts receivable. By estimating and recording the allowance, companies can provide a more accurate picture of their financial position and manage their credit risk more effectively. However, the estimation and recording of the allowance can be complex and require significant judgment, and companies must carefully consider the benefits and limitations of the allowance to ensure that it is accurately reflected in their financial statements.