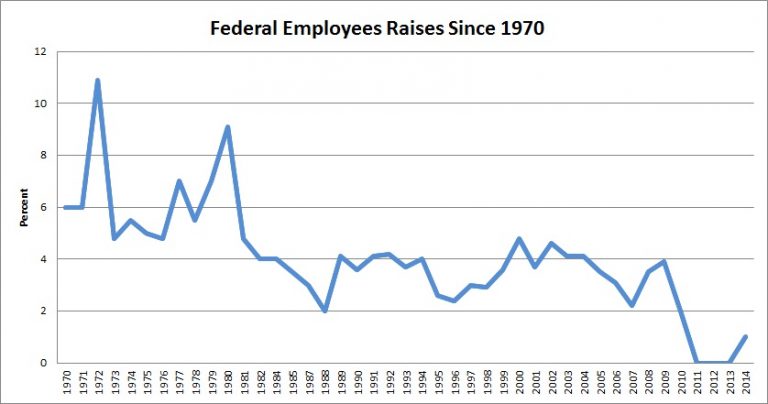

Federal Pay Raises By Year

The issue of federal pay raises is a critical one, affecting the livelihoods of millions of federal employees across the United States. Over the years, these raises have been a topic of much debate, with various factors influencing their implementation, including economic conditions, budget constraints, and political considerations. To understand the evolution of federal pay raises, it’s essential to examine them on a year-by-year basis, considering the historical context, legislative actions, and executive decisions that have shaped these increases.

Historical Context of Federal Pay Raises

Federal pay raises are not merely a matter of employee compensation; they are intricately linked to the overall health of the economy, the budget priorities of the government, and the political climate of the time. Historically, these raises have been designed to keep pace with inflation, ensure the government remains competitive in the job market, and reward federal employees for their service. However, the process of determining these raises is complex, involving congressional approvals, presidential decisions, and sometimes, automatic adjustments based on cost-of-living indexes.

Evolution of Federal Pay Raise Policies

The policy framework surrounding federal pay raises has evolved significantly over the years. Prior to the 1960s, federal pay was largely stagnant, with occasional adjustments that often failed to keep pace with private sector wage growth. The introduction of the Classification Act of 1949 and subsequent amendments aimed to create a more structured pay system, but it wasn’t until the 1970s and 1980s that more systematic approaches to federal pay raises were adopted. The Federal Employees Pay Comparability Act of 1990, for example, introduced the concept of locality pay to adjust federal salaries based on regional cost-of-living differences.

Year-by-Year Analysis of Federal Pay Raises

Analyzing federal pay raises on a year-by-year basis provides insight into how these increases reflect broader economic and political trends. For instance:

- 2022: Given the economic challenges posed by the COVID-19 pandemic and the subsequent inflationary pressures, the 2022 federal pay raise was a subject of considerable debate. Ultimately, federal employees received an average pay increase of 2.7%, with higher increases for certain localities to reflect varying costs of living.

- 2021: The year 2021 saw a modest federal pay increase of 1% across the board, as part of the Consolidated Appropriations Act, 2021. This relatively small increase was influenced by the ongoing pandemic and its economic impacts.

- 2020: In 2020, federal employees received a 3.1% pay raise, consisting of a 2.6% across-the-board increase and an average 0.5% increase in locality pay. This raise was part of the Further Consolidated Appropriations Act, 2020, and reflected efforts to keep federal salaries competitive amidst a growing economy.

- 2019: The 2019 federal pay raise was 1.9%, with an average 0.9% increase in locality pay, as part of the Consolidated Appropriations Act, 2019. This increase aimed to address concerns about federal employee pay competitiveness, especially in high-cost areas.

- 2018: Federal employees received a 1.4% pay increase in 2018, reflecting a modest adjustment amidst budget constraints and discussions about the size and efficiency of the federal workforce.

Factors Influencing Federal Pay Raises

Several factors contribute to the determination of federal pay raises, including:

- Economic Conditions: The state of the economy, including inflation rates, unemployment levels, and overall growth, significantly influences federal pay raise decisions. Raises are often calibrated to ensure that federal salaries keep pace with the private sector and inflation.

- Budget and Fiscal Policy: The government’s budget priorities and fiscal policies play a crucial role. In times of budget austerity, pay raises may be limited or even frozen, while in periods of economic expansion, more generous increases may be possible.

- Legislative and Executive Actions: Both Congress and the President have roles in determining federal pay raises. Legislation can mandate specific increases, and the President can propose budgetary allocations that impact federal employee compensation.

- Public Sector Comparisons: The competitiveness of federal salaries compared to the private sector and state/local governments is a critical consideration. Studies, such as those conducted by the Federal Salary Council, provide data that informs these comparisons.

Conclusion

Federal pay raises are a complex and multifaceted issue, influenced by a variety of economic, political, and social factors. By examining these raises on a year-by-year basis, it becomes clear that they are not isolated events but part of a broader narrative about public service, compensation, and the role of the federal government in the economy. As the United States continues to navigate shifting economic landscapes, political priorities, and societal values, the future of federal pay raises will remain a critical and contentious issue.

FAQ Section

What determines the size of federal pay raises each year?

+The size of federal pay raises is determined by a combination of factors, including economic conditions, budget priorities, legislative actions, and comparisons with the private sector. These elements are considered by both Congress and the President to decide the appropriate level of increase.

How do locality pay adjustments work?

+Locality pay adjustments are made to reflect the varying costs of living in different areas of the country. These adjustments ensure that federal employees in higher-cost areas receive salaries that are more comparable to those in the private sector, thus helping the government to attract and retain talent across different regions.

Can federal pay raises be frozen or reduced?

+Yes, federal pay raises can be frozen or reduced. This has occurred in the past, particularly during times of budget constraints or economic downturns. Such decisions are typically made through legislative or executive actions and are designed to address fiscal challenges faced by the government.