Resale Certificate Florida

When conducting business in the state of Florida, understanding the nuances of sales tax is crucial for maintaining compliance and avoiding unnecessary penalties. One key component of this compliance is the use of a resale certificate, which allows businesses to purchase items exempt from sales tax, provided those items are intended for resale. In this article, we will delve into the specifics of resale certificates in Florida, including their purpose, how to obtain one, and the proper procedure for using them.

What is a Resale Certificate?

A resale certificate, also known as a sales tax exemption certificate, is a document that indicates a buyer intends to resell the goods purchased, rather than using them for personal consumption. This certification is provided by the purchaser to the seller, serving as a guarantee that the goods are being bought for resale purposes and, therefore, should not be subject to sales tax. The resale certificate is a way for businesses to legally avoid paying sales tax on items that will eventually be sold to consumers, helping to prevent double taxation.

How to Obtain a Resale Certificate in Florida

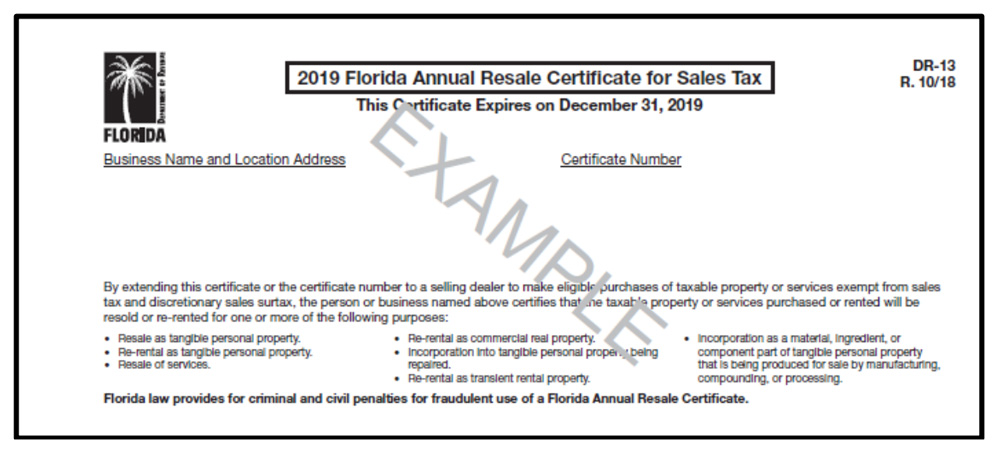

To obtain a resale certificate in Florida, businesses typically need to register for a sales tax permit with the Florida Department of Revenue. This process involves several steps: 1. Apply for a Sales Tax Permit: Before applying for a resale certificate, a business must first obtain a sales tax permit (also known as a seller’s permit or resale number) from the Florida Department of Revenue. This permit indicates that the business is authorized to collect sales tax on taxable sales. 2. Fill Out Form DR-13: Once the business has a sales tax permit, they can fill out Form DR-13, which is the Application for Certificate of Exemption. However, for resale purposes, the actual certificate used is usually provided by the seller, and the buyer fills it out. 3. Submit the Application: The application for a sales tax permit can be submitted online through the Florida Department of Revenue’s website or by mail.

Using a Resale Certificate in Florida

After obtaining a resale certificate, it’s essential to understand how to properly use it. Here are some guidelines: - Provide the Certificate to the Seller: When making a purchase for resale, the buyer must provide a completed resale certificate to the seller. This certificate must include the buyer’s name, address, sales tax permit number (if applicable), a description of the items being purchased, and a statement that the items are being purchased for resale. - Ensure Accuracy and Completeness: It’s crucial that the resale certificate is filled out accurately and completely. Incomplete or inaccurate certificates may not be accepted by the seller, which could result in the seller charging sales tax on the purchase. - Keep Records: Both buyers and sellers should keep a record of all resale certificates provided or received. These records can be crucial in case of an audit, as they provide proof that items were purchased for resale and, therefore, exempt from sales tax.

Example of a Resale Certificate in Florida

To help illustrate the process, let’s consider an example. Suppose a retail store in Miami purchases merchandise from a wholesaler for the purpose of reselling it to customers. In this case, the retailer would provide a completed resale certificate to the wholesaler, ensuring that the purchase is exempt from Florida sales tax. The certificate would include: - The retailer’s business name and address - The retailer’s Florida sales tax permit number - A description of the merchandise being purchased - A statement indicating that the merchandise is being purchased for resale

Frequently Asked Questions

What is the purpose of a resale certificate in Florida?

+The purpose of a resale certificate in Florida is to exempt businesses from paying sales tax on items they intend to resell, thus preventing double taxation.

How do I obtain a resale certificate in Florida?

+To obtain a resale certificate in Florida, you first need to register for a sales tax permit with the Florida Department of Revenue. The actual resale certificate to be used is typically provided by the seller and filled out by the buyer.

What information must be included on a resale certificate in Florida?

+A resale certificate in Florida must include the buyer's name, address, sales tax permit number (if applicable), a description of the items being purchased, and a statement that the items are being purchased for resale.

Conclusion

Resale certificates play a vital role in the operation of businesses in Florida, enabling them to purchase goods for resale without incurring sales tax. By understanding the process of obtaining and using a resale certificate, businesses can ensure compliance with Florida’s sales tax laws, avoid unnecessary tax liabilities, and maintain a competitive edge in their market. Whether you’re a seasoned business owner or just starting a new venture, grasping the nuances of resale certificates can contribute significantly to the financial health and legal compliance of your business.