Us Military Pay Rates

The United States military pay rates are a complex system that varies based on rank, time in service, and occupation. The pay rates are determined by the Department of Defense and are adjusted annually to reflect changes in the cost of living and other factors. In this article, we will delve into the intricacies of the US military pay rates, exploring the different components, benefits, and allowances that make up the total compensation package.

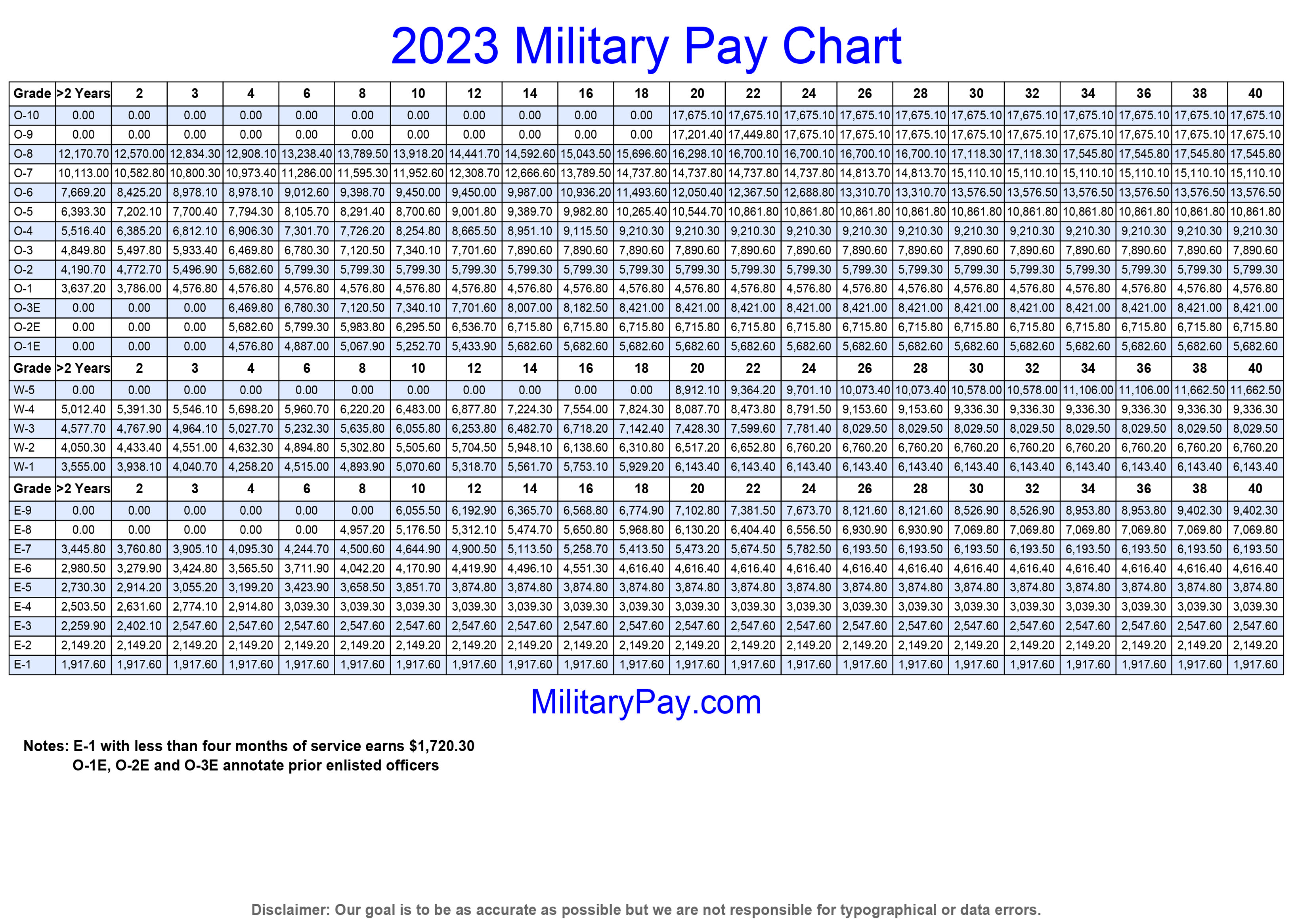

To begin with, it’s essential to understand the basic pay structure of the US military. The pay rates are divided into two main categories: enlisted and officer. Enlisted personnel are further divided into nine pay grades, ranging from E-1 (Private) to E-9 (Sergeant Major). Officers, on the other hand, are divided into eleven pay grades, ranging from O-1 (Second Lieutenant) to O-10 (General). The pay rates for each grade are determined by the individual’s time in service, with longer-serving members receiving higher pay rates.

Basic Pay Rates

The basic pay rates for enlisted personnel range from 1,733.40 per month for a Private (E-1) with less than two years of service to 8,926.50 per month for a Sergeant Major (E-9) with over 30 years of service. For officers, the basic pay rates range from 3,287.10 per month for a Second Lieutenant (O-1) with less than two years of service to 19,762.50 per month for a General (O-10) with over 30 years of service.

| Pay Grade | Monthly Basic Pay |

|---|---|

| E-1 (Private) | $1,733.40 |

| E-2 (Private First Class) | $1,942.50 |

| E-3 (Specialist/Corporal) | $2,105.70 |

| E-4 (Sergeant) | $2,515.80 |

| E-5 (Staff Sergeant) | $2,775.60 |

| E-6 (Sergeant First Class) | $3,294.30 |

| E-7 (Master Sergeant) | $3,805.40 |

| E-8 (First Sergeant) | $4,586.40 |

| E-9 (Sergeant Major) | $8,926.50 |

| O-1 (Second Lieutenant) | $3,287.10 |

| O-2 (First Lieutenant) | $4,136.40 |

| O-3 (Captain) | $5,334.60 |

| O-4 (Major) | $6,552.60 |

| O-5 (Lieutenant Colonel) | $8,184.00 |

| O-6 (Colonel) | $10,562.80 |

| O-7 (Brigadier General) | $13,647.30 |

| O-8 (Major General) | $15,980.40 |

| O-9 (Lieutenant General) | $18,227.10 |

| O-10 (General) | $19,762.50 |

Allowances and Benefits

In addition to basic pay, members of the US military are entitled to a range of allowances and benefits that can significantly enhance their total compensation package. These allowances include:

- Basic Allowance for Housing (BAH): This allowance is designed to offset the cost of housing for members who do not live in government-provided quarters. The BAH rates vary depending on the location, with urban areas typically receiving higher rates than rural areas.

- Basic Allowance for Subsistence (BAS): This allowance is intended to cover the cost of food for members and their families. The BAS rate is currently 369.39 per month for enlisted personnel and 253.63 per month for officers.

- Cost of Living Allowance (COLA): This allowance is designed to offset the higher cost of living in certain areas, such as Hawaii or Alaska. The COLA rates vary depending on the location and the individual’s rank and family size.

- Special Pay: Some members may be eligible for special pay, such as jump pay, flight pay, or hazardous duty pay, depending on their occupation and duties.

- Education Benefits: The US military offers a range of education benefits, including the GI Bill, which can help members pay for college or vocational training.

- Healthcare Benefits: Members of the US military and their families are entitled to comprehensive healthcare benefits, including medical, dental, and pharmacy coverage.

Special Pay and Incentives

The US military also offers a range of special pay and incentives to attract and retain members with critical skills or to compensate for hazardous or difficult duties. Some examples include:

- Enlistment Bonuses: The US military offers enlistment bonuses to new recruits who enlist in certain occupations or agree to serve for a certain period.

- Reenlistment Bonuses: Members who reenlist may be eligible for reenlistment bonuses, which can range from a few thousand dollars to over $100,000, depending on the individual’s rank, occupation, and length of service.

- Special Duty Pay: Members who serve in special duty positions, such as recruiters or drill instructors, may be eligible for special duty pay.

- Hazardous Duty Pay: Members who serve in hazardous duty positions, such as explosive ordnance disposal or special operations, may be eligible for hazardous duty pay.

Tax Benefits

Members of the US military are also entitled to a range of tax benefits, including:

- Tax-Free Allowances: Many military allowances, such as BAH and BAS, are tax-free, which can significantly reduce the individual’s tax liability.

- Combat Zone Tax Exclusion: Members who serve in combat zones may be eligible for a tax exclusion, which can reduce their taxable income.

- Military Tax Credits: The US military offers a range of tax credits, such as the military moving expense credit, which can help offset the cost of relocating.

Conclusion

In conclusion, the US military pay rates are a complex system that varies based on rank, time in service, and occupation. While the basic pay rates provide a foundation for the compensation package, the allowances, benefits, and special pay can significantly enhance the total compensation. The US military offers a range of tax benefits, education benefits, and healthcare benefits that can help members and their families achieve financial stability and security.

How do US military pay rates compare to civilian pay rates?

+The US military pay rates are generally competitive with civilian pay rates, especially when factoring in the allowances and benefits. However, the pay rates can vary significantly depending on the occupation and rank.

What is the average salary for a US military member?

+The average salary for a US military member varies depending on the rank and occupation. However, according to the Department of Defense, the average annual salary for an enlisted member is around $40,000, while the average annual salary for an officer is around $60,000.

How do I calculate my US military pay?

+To calculate your US military pay, you can use the Department of Defense's pay calculator, which takes into account your rank, time in service, and occupation. You can also consult with a military pay specialist or use online resources to estimate your pay.

In summary, the US military pay rates are a complex system that offers a range of benefits and allowances to attract and retain members. By understanding the different components of the pay rates, members can make informed decisions about their careers and financial planning. Whether you’re a new recruit or a seasoned veteran, it’s essential to stay up-to-date on the latest pay rates and benefits to ensure you’re getting the most out of your military service.