What Is An Itemized Receipts

The concept of itemized receipts is a fundamental aspect of financial record-keeping, particularly in the context of business transactions, taxation, and personal finance. An itemized receipt is a detailed document that lists each item or service purchased, along with its corresponding cost, allowing for a clear breakdown of the total amount spent. This type of receipt is essential for maintaining accurate financial records, facilitating budgeting, and ensuring compliance with tax regulations.

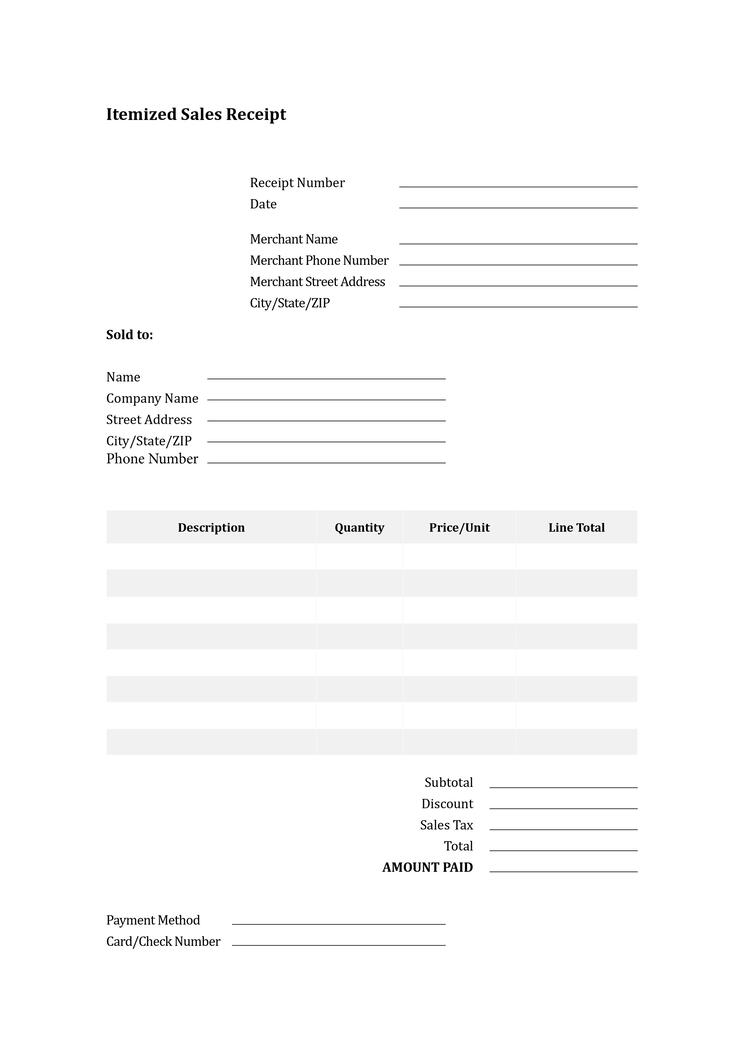

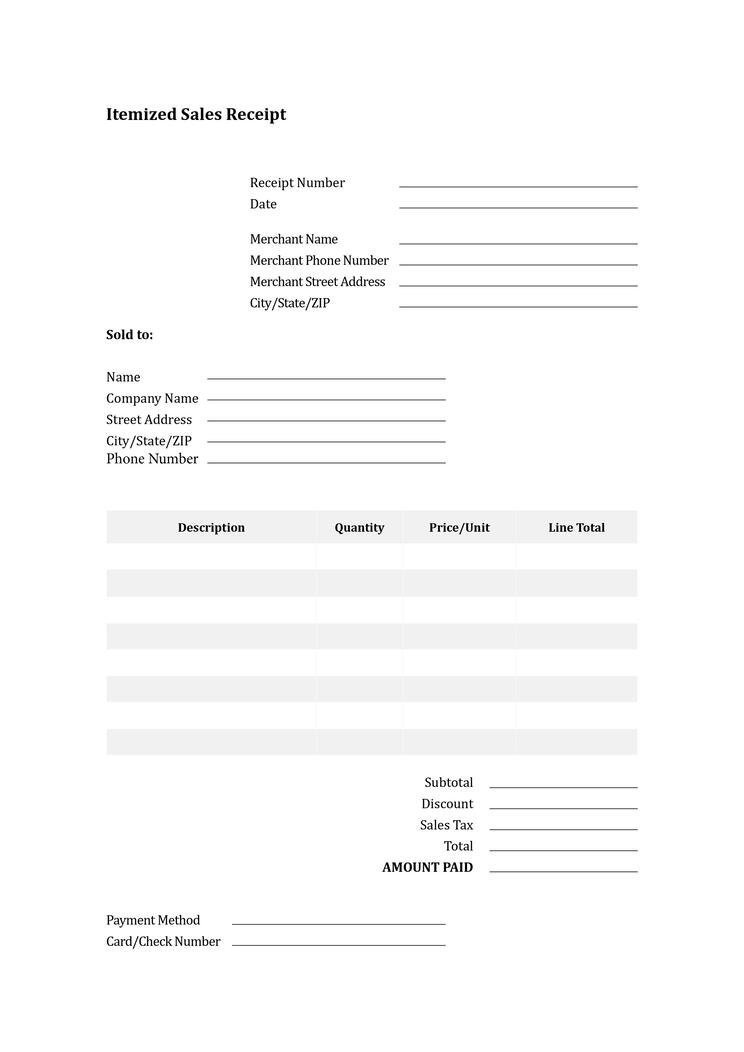

In essence, an itemized receipt serves as a comprehensive record of a transaction, providing a transparent and detailed account of the goods or services acquired. It typically includes the date of purchase, the name and address of the vendor, a description of each item or service, the quantity purchased, the unit price, and the total cost. This level of detail enables individuals and businesses to track their expenses, identify areas for cost reduction, and make informed financial decisions.

The significance of itemized receipts extends beyond personal finance to the realm of business and taxation. In many jurisdictions, businesses are required to provide itemized receipts to customers for transactions exceeding a certain threshold. This requirement helps to prevent tax evasion, ensures transparency in business dealings, and facilitates the auditing process. Furthermore, itemized receipts can serve as valuable evidence in the event of disputes or disagreements regarding the terms of a transaction.

To illustrate the importance of itemized receipts, consider a scenario where an individual purchases a variety of goods from a retail store. The itemized receipt would list each item, its price, and the total cost, allowing the individual to verify the accuracy of the transaction and track their expenses. In the event of a return or exchange, the itemized receipt would provide a clear record of the original purchase, facilitating the process and minimizing potential disputes.

In addition to their practical applications, itemized receipts also play a crucial role in maintaining the integrity of financial records. By providing a detailed account of each transaction, itemized receipts help to prevent errors, discrepancies, and potential fraud. This, in turn, contributes to the overall reliability and accuracy of financial statements, facilitating informed decision-making and ensuring compliance with regulatory requirements.

The following is an example of what an itemized receipt might look like:

| Item | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Product A | 2 | $10.00 | $20.00 |

| Product B | 1 | $5.00 | $5.00 |

| Product C | 3 | $7.50 | $22.50 |

| Total | $47.50 |

This example illustrates the level of detail and transparency that an itemized receipt provides, enabling individuals and businesses to maintain accurate financial records and make informed decisions.

FAQs:

What is the purpose of an itemized receipt?

+An itemized receipt provides a detailed breakdown of the goods or services purchased, allowing for accurate financial record-keeping, budgeting, and compliance with tax regulations.

What information is typically included on an itemized receipt?

+An itemized receipt typically includes the date of purchase, the name and address of the vendor, a description of each item or service, the quantity purchased, the unit price, and the total cost.

Why are itemized receipts important for businesses?

+Itemized receipts help businesses maintain accurate financial records, prevent tax evasion, and ensure transparency in business dealings. They also facilitate the auditing process and provide valuable evidence in the event of disputes.

In conclusion, itemized receipts play a vital role in maintaining accurate financial records, facilitating budgeting, and ensuring compliance with tax regulations. Their significance extends beyond personal finance to the realm of business and taxation, highlighting the importance of transparency and detail in financial transactions. By understanding the purpose and benefits of itemized receipts, individuals and businesses can make informed decisions, maintain the integrity of their financial records, and ensure compliance with regulatory requirements.