What Is Delta Dental Lines? Your Insurance Guide

Delta Dental is one of the largest and most well-established dental insurance providers in the United States, offering a wide range of plans to individuals, families, and groups. With a history spanning over 60 years, Delta Dental has built a reputation for providing comprehensive and affordable dental coverage to millions of people across the country. In this article, we will delve into the details of Delta Dental lines, exploring the various plans, benefits, and features that make it a popular choice among dental insurance seekers.

Introduction to Delta Dental

Delta Dental is a non-profit organization that operates as a network of 39 independent Delta Dental companies, each serving a specific region or state. This unique structure allows Delta Dental to tailor its plans and services to meet the specific needs of local communities, while also providing a broad national network of participating dentists. With a strong focus on oral health and preventive care, Delta Dental aims to make dental insurance accessible and affordable for everyone.

Types of Delta Dental Plans

Delta Dental offers a variety of plans to suit different needs and budgets. These plans can be broadly categorized into individual and family plans, group plans for employers, and Medicare Advantage plans for seniors. Here’s a brief overview of each:

- Individual and Family Plans: Designed for those who are not covered by an employer-sponsored plan, these plans offer flexible options for individuals and families. They often include a range of deductibles, copayments, and annual limits to suit different financial situations.

- Group Plans: Offered to employers as a benefit for their employees, group plans can be tailored to fit the needs and size of the organization. They typically offer more comprehensive coverage with lower out-of-pocket costs compared to individual plans.

- Medicare Advantage Plans: For seniors and individuals with disabilities, Delta Dental offers Medicare Advantage plans that include dental coverage. These plans are designed to work in conjunction with Medicare to provide comprehensive health and dental benefits.

Benefits and Features of Delta Dental Plans

Delta Dental plans come with a multitude of benefits and features designed to support oral health and make dental care more accessible. Some of the key advantages include:

- Extensive Network: Delta Dental boasts one of the largest networks of participating dentists, ensuring that policyholders have access to quality dental care virtually anywhere in the country.

- Preventive Care: Most plans cover preventive services like routine cleanings, exams, and X-rays at little to no out-of-pocket cost, encouraging policyholders to prioritize their oral health.

- Comprehensive Coverage: Plans often include coverage for basic procedures like fillings and extractions, as well as major services such as crowns, bridges, and dentures.

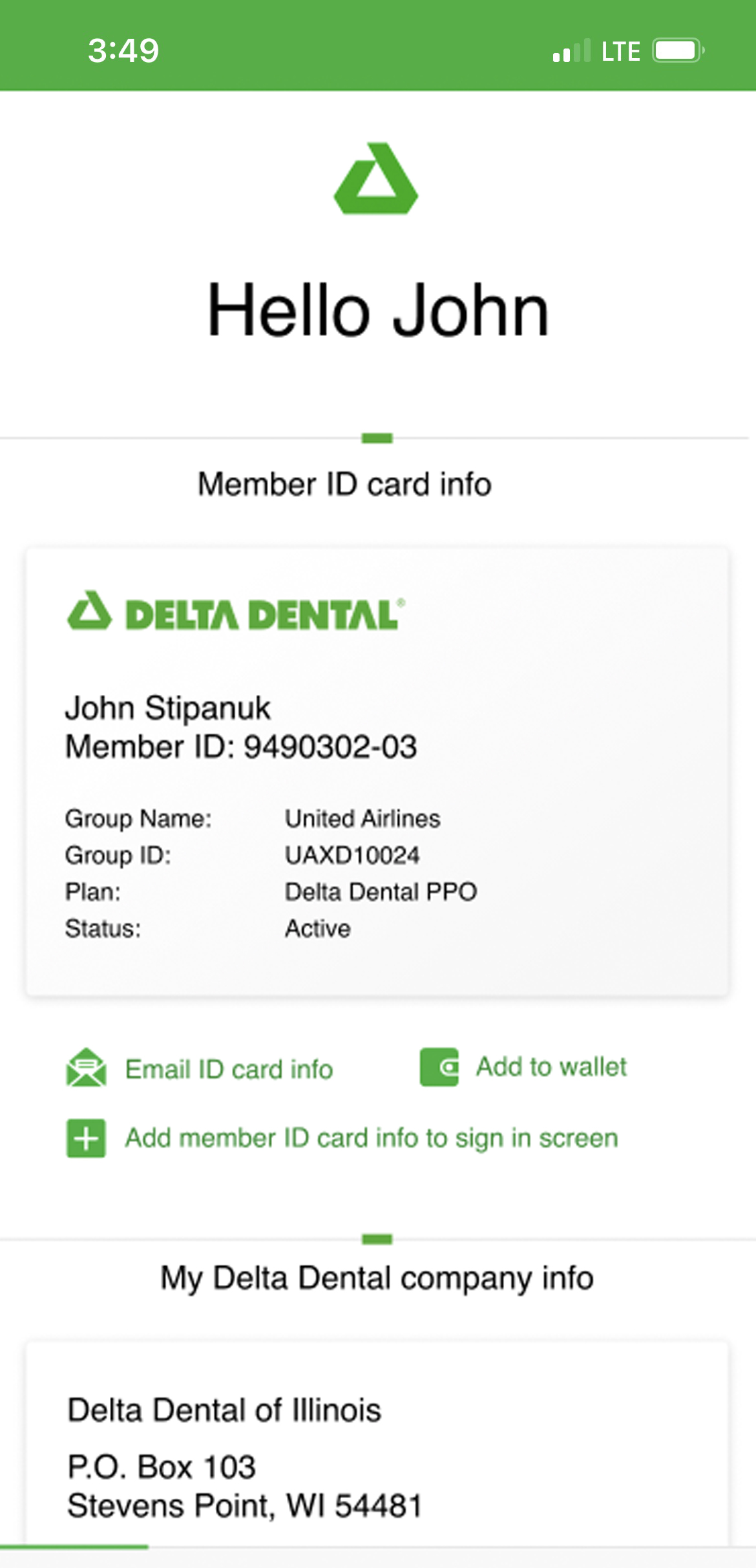

- Convenience: With online tools and mobile apps, policyholders can easily manage their accounts, find participating dentists, and access their benefits information.

How to Choose the Right Delta Dental Plan

With so many options available, selecting the right Delta Dental plan can seem overwhelming. Here are some steps to consider:

- Assess Your Needs: Consider the dental needs of yourself and your family. Do you need basic coverage for routine care, or do you anticipate needing more extensive dental work?

- Compare Plans: Look at the different plans available in your area, comparing deductibles, copayments, annual limits, and covered services.

- Check the Network: Ensure that your current dentist or a dentist you prefer is part of the Delta Dental network.

- Evaluate Costs: Calculate the total cost of the plan, including premiums, out-of-pocket expenses, and any potential savings from preventive care coverage.

- Seek Professional Advice: If possible, consult with a licensed insurance agent or broker who can provide guidance tailored to your situation.

Conclusion

Delta Dental lines offer a robust and flexible set of options for those seeking dental insurance. By understanding the types of plans available, their benefits, and how to choose the right one, individuals and families can make informed decisions about their dental health coverage. With its extensive network, focus on preventive care, and comprehensive coverage options, Delta Dental is a leading choice for dental insurance in the United States.

Frequently Asked Questions

What is the difference between Delta Dental's individual and family plans?

+Delta Dental's individual and family plans are designed for those who do not have access to group coverage through an employer. The main difference between these plans is the number of people covered and the cost, with family plans covering multiple individuals under one policy.

Can I keep my current dentist if I switch to a Delta Dental plan?

+It depends on whether your current dentist participates in the Delta Dental network. Delta Dental has an extensive network of dentists, but it's always a good idea to check beforehand to ensure your dentist is part of the network.

How do I find a Delta Dental dentist in my area?

+Delta Dental provides online tools and resources that allow you to search for participating dentists in your area. You can visit their website, use their mobile app, or contact their customer service directly for assistance.

By considering these factors and exploring the options available through Delta Dental, individuals can make informed decisions about their dental health coverage, ensuring they have access to quality care when they need it.