What Is Sales Tax Rate In Georgia

Understanding the sales tax rate in Georgia is essential for both residents and businesses to navigate the state’s tax landscape effectively. The sales tax in Georgia is a combination of state and local taxes. As of the last update, the state sales tax rate in Georgia is 4%. However, this rate can vary depending on the location within the state because local jurisdictions (such as counties and cities) can add their own sales taxes.

State Sales Tax

The state of Georgia imposes a sales tax of 4% on the purchase of most goods and certain services. This tax is collected by the seller and remitted to the state.

Local Sales Tax

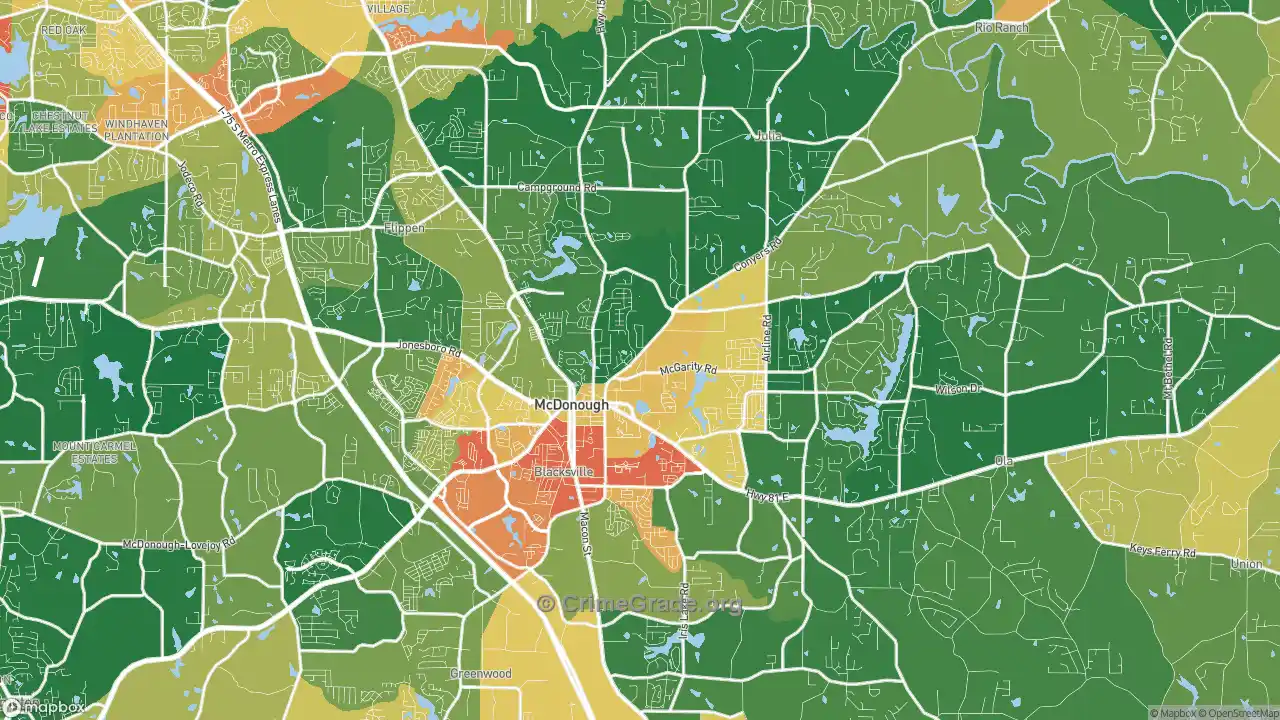

In addition to the state sales tax, local jurisdictions in Georgia are allowed to impose their own sales taxes. The local sales tax rates can vary significantly from one location to another. These taxes are also collected by the seller and then distributed to the respective local governments.

Combined Sales Tax Rate

The combined sales tax rate, which includes both state and local taxes, can range from 4% (in areas with no local tax) to over 8% in some locations. For example, as of the last update, some areas in Georgia have a total sales tax rate of 7% or 8%, combining the state’s 4% with local taxes that can range from 3% to 4%.

Special Taxes and Exemptions

Georgia also has special taxes and exemptions that can affect the total sales tax rate or the applicability of sales tax to certain goods and services. For instance, some food items and prescription drugs are exempt from sales tax, while other items like alcoholic beverages may be subject to additional taxes beyond the standard sales tax rate.

Calculation Example

To understand how the sales tax works, let’s consider an example. If you purchase an item worth 100 in an area with a total sales tax rate of 7% (4% state tax + 3% local tax), the sales tax would be 7 (100 * 7%). Therefore, you would pay 107 for the item.

Importance of Current Information

It’s crucial to obtain the most current sales tax rates for specific locations in Georgia, as these rates can change. The Georgia Department of Revenue is the best source for up-to-date information on sales tax rates across the state. They provide detailed information on tax rates by jurisdiction, tax exemptions, and how to comply with Georgia’s sales tax laws.

FAQ Section

What is the current state sales tax rate in Georgia?

+The current state sales tax rate in Georgia is 4%.

Can local jurisdictions in Georgia impose their own sales taxes?

+How do I find the sales tax rate for a specific location in Georgia?

+You can find the most accurate and up-to-date sales tax rates for specific locations in Georgia by visiting the Georgia Department of Revenue's website or contacting them directly.

Understanding and adhering to the sales tax rates and regulations in Georgia is vital for consumers and businesses alike. Staying informed about any changes to these rates and ensuring compliance can help in avoiding any potential issues related to sales tax.